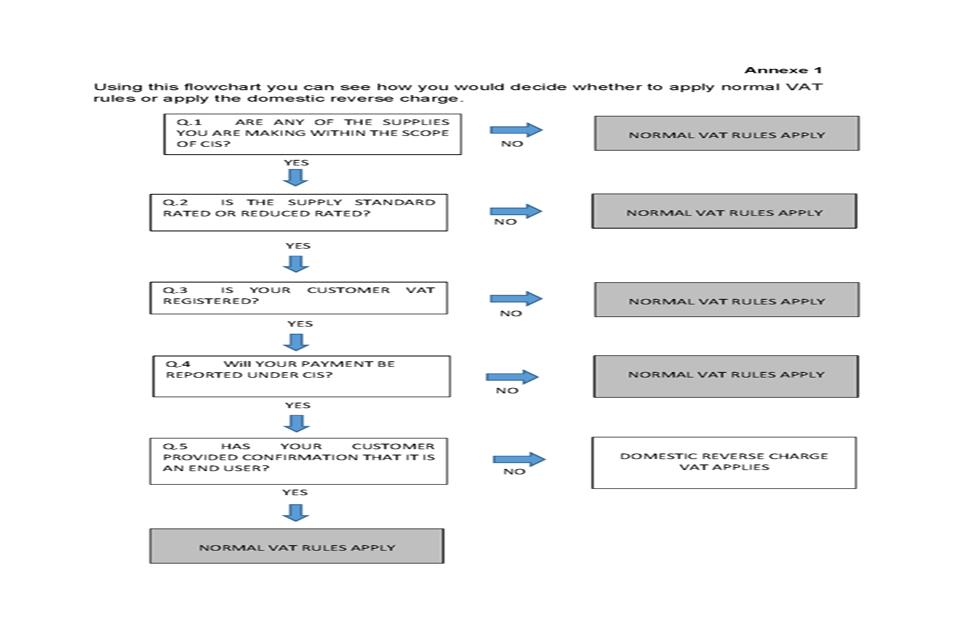

Reverse Charge Vat | Domestic vat reverse charge on specific goods and services. Vat reverse charge means that customers are able to charge themselves vat and pay it directly to hm revenue and customs (hmrc) rather than the supplier sending them an invoice at a later date. The reverse charge is how you must account for vat on services that you buy from businesses who are based outside the uk. Does the vat reverse charge for construction services apply to work provided for home/domestic users? They're businesses, or groups of businesses, that are vat and construction industry scheme registered but.

We're here to ensure that by the time you're done reading this article you'll be in a better position to approach the reverse. It intends to cut down on missing trader fraud. If you are not registered for vat, the reverse charge will not apply to you. Hmrc believe that there is significant potential fraud within the sector. Reverse charge is a tax schema that moves the responsibility for the accounting and reporting of vat from the seller to the buyer of goods and/or services.

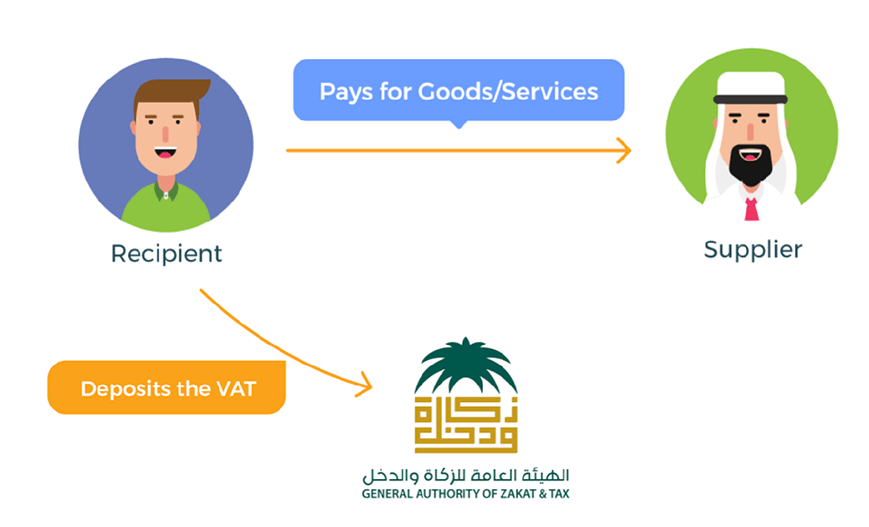

For reverse charge purposes consumers and final customers are called end users. The vat reverse charge will change the way in which building contractors account for vat, on some of their supplies, from 1 october 2019. If you are not registered for vat, the reverse charge will not apply to you. Thus, reverse charged vat improves tax collection. This page explains the vat treatment of reverse charge, self accounting. For example, people receiving the vat from their customers but not accounting for it. As a result, the reporting and payment of vat passes to the customer. Vat reverse charge means that customers are able to charge themselves vat and pay it directly to hm revenue and customs (hmrc) rather than the supplier sending them an invoice at a later date. An aspect of fiscal policy. What if i'm invoicing for mixed supplies that includes a vat reverse charge component? This reverse charge also applies on domestic supplies, however, in this case it is not required that the supplier is not established. Reverse charged vat is used in some territories to collect tax on purchases from suppliers who are not subject to the tax authority's jurisdiction. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer.

Reverse charged vat is used in some territories to collect tax on purchases from suppliers who are not subject to the tax authority's jurisdiction. It intends to cut down on missing trader fraud. Vat reverse charge means that customers are able to charge themselves vat and pay it directly to hm revenue and customs (hmrc) rather than the supplier sending them an invoice at a later date. The reverse charge is how you must account for vat on services that you buy from businesses who are based outside the uk. Domestic vat reverse charge on specific goods and services.

You may reclaim the input tax on your domestic reverse charge purchases in box 4 of the vat return and include the value of the. Vat reverse charge means that customers are able to charge themselves vat and pay it directly to hm revenue and customs (hmrc) rather than the supplier sending them an invoice at a later date. For reverse charge purposes consumers and final customers are called end users. This reverse charge also applies on domestic supplies, however, in this case it is not required that the supplier is not established. Thus, reverse charged vat improves tax collection. The principle of the vat reverse charge imposes on foreign companies not to charge vat to in this operation, the supplier in bologna will send his total invoice (taxes included) to the french company. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. The vat reverse charge is a complicated word for a simple concept. Building contractors must comply with the new rules if they. If you are not registered for vat, the reverse charge will not apply to you. Does the vat reverse charge for construction services apply to work provided for home/domestic users? Why is vat reverse charge being introduced?

Understand the concept of reverse charge mechanism under vat and find out the goods and the mechanism of collecting tax by a registered supplier from his customers is known as forward charge. An aspect of fiscal policy. Reverse charge is a tax schema that moves the responsibility for the accounting and reporting of vat from the seller to the buyer of goods and/or services. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input vat) and the supplier's sale (output vat) in their vat return. We're here to ensure that by the time you're done reading this article you'll be in a better position to approach the reverse.

Thus, reverse charged vat improves tax collection. Hmrc believe that there is significant potential fraud within the sector. Therefore, recipients of goods and/or services. For example, people receiving the vat from their customers but not accounting for it. They're businesses, or groups of businesses, that are vat and construction industry scheme registered but. You are permitted to deduct the vat charged over any related costs you have incurred. We're here to ensure that by the time you're done reading this article you'll be in a better position to approach the reverse. We tell you what the vat reverse charge is and why your invoices should bear a specific mention! What if i'm invoicing for mixed supplies that includes a vat reverse charge component? Are you familiar with reverse charge vat? As a result, the reporting and payment of vat passes to the customer. If you're not, you don't have to worry. This reverse charge also applies on domestic supplies, however, in this case it is not required that the supplier is not established.

Reverse Charge Vat: It intends to cut down on missing trader fraud.

Konversi Kode